Arab Bank Switzerland is Adding Ripple.

Swiss Arab Bank Joins Ripple's Global Network of Financial Firms

Swiss Arab Bank joins Ripple's global network of financial firms.

Ripple announced today that Swiss Arab Bank has joined the RippleNet, the company's global network of banks and financial institutions. This addition brings the number of members on RippleNet to more than 60 leading institutions from around the world.

"We are excited to join the RippleNet and work with the team at Ripple to provide our customers with an innovative and efficient financial services experience," said Mohamed El-Erian, CEO of Swiss Arab Bank. "Ripple's blockchain technology offers us a new way to improve the cross-border payments process for our customers."

Ripple's xCurrent solution allows banks to quickly and easily send money to other banks around the world, providing a faster, more cost-effective way to move money than traditional correspondent banking. xCurrent is currently being used by banks and financial institutions around the world to improve their cross-border payments infrastructure.

"We are thrilled that Swiss Arab Bank has joined the RippleNet," said Brad Garlinghouse, CEO of Ripple. "Their membership will help facilitate global payments for their customers in a more efficient and cost-effective way. Ripple's xCurrent solution is leading the way in providing a fast, cost-effective way for banks to move money around the world."

Ripple to Welcome Arab Bank Switzerland to Its Global Ecosystem

Ripple has welcomed Arab Bank Switzerland to its global ecosystem.

Arab Bank Switzerland joins Ripple’s growing list of financial institutions that use the company’s blockchain technology to improve cross-border payments.

Ripple offers quick, cost-effective and secure global payments solutions, enabling banks to improve their customer experience and shave off costs.

“We’re excited to welcome Arab Bank Switzerland to our global ecosystem,” said Brad Garlinghouse, CEO of Ripple. “Their adoption of Ripple technology will help them streamline their cross-border payments and deliver a better experience to their customers.”

Arab Bank Switzerland is a leading Swiss bank with more than $250 billion in assets. The bank is using Ripple’s technology to improve the way it handles international payments.

“We’re excited to join the Ripple ecosystem and use its cutting-edge technology to improve the way we handle international payments,” said Hisham Zaki, Head of Corporate Banking at Arab Bank Switzerland. “Ripple’s blockchain technology enables us to move quickly and efficiently between our own networks and with our partners, providing a better experience for our customers.”

Other financial institutions that have adopted Ripple’s blockchain technology include American Express, BNP Paribas, Santander, and UniCredit.

Arab Bank Switzerland to Adopt Ripple Technology for Payments

Switzerland’s largest bank, the Swiss Bank Arab, has announced that it will be adopting Ripple’s technology for its cross-border payments. The bank stated that it will use Ripple’s xCurrent product to improve its current payments infrastructure.

This move by the Swiss bank is likely to increase the adoption of Ripple’s technology across the global financial sector. xCurrent is a Ripple product that allows banks to make and receive payments quickly and easily.

Ripple’s CEO, Brad Garlinghouse, commented on the news, stating that:

“We are thrilled that Arab Bank Switzerland has announced its intention to use xCurrent to improve its cross-border payment experience. This is another example of how Ripple’s innovative technology is helping to reshape the global payments landscape.”

This announcement follows earlier this year when Japanese bank SBI Holdings announced that it would be using Ripple’s blockchain technology to improve its global payments network.

How Ripple Will Help Arab Bank Switzerland Streamline Banking Services

Ripple is a digital asset and payment network that allows for quick and easy transactions between parties. Ripple has already been adopted by a number of banks, including Arab Bank Switzerland, which is using it to streamline their banking services.

By using Ripple, Arab Bank Switzerland is able to reduce the time it takes to process transactions and make them more efficient. This is especially important given the bank's goal of providing its customers with the best possible service.

In addition, Ripple's ability to facilitate cross-border payments makes it a valuable tool for banks such as Arab Bank Switzerland. This is especially true given the region's growing economic ties with countries such as China and India.

By using Ripple, Arab Bank Switzerland is able to improve its overall customer experience and increase its competitiveness in the banking sector.

Swiss Arab Bank Gains Access to Ripple's Cross-Border Payment System

Swiss Arab Bank (SAB), one of the largest banks in the Middle East, has announced that it has joined Ripple's global network of banks and financial institutions that use the Ripple payment system to make cross-border payments.

By using the Ripple network, SAB can speed up the processing of payments and reduce costs. In addition, the bank can also improve its customer experience by providing a smooth and efficient payment process.

Ripple's cross-border payment system is used by banks to make international payments in a fast, reliable, and cost-effective manner. This system allows banks to reduce the time it takes to send payments and to reduce the costs associated with making international payments.

SAB joins other major banks that use Ripple's payment system, including BBVA, Banco Santander, and ING. These banks are able to provide their customers with a more efficient and reliable payment experience.

Benefits of Utilizing Ripple for Arab Bank Switzerland

One of the many benefits of utilizing Ripple for Arab Bank Switzerland is that it provides a fast and efficient way to move money around the world. This is particularly useful for transferring funds between different countries, as well as between different banks. Additionally, Ripple can help to reduce the time it takes to process transactions, making them more efficient and faster.

How Ripple Can Enhance the Banking Experiences of Customers at Arab Bank Switzerland

Ripple has already been embraced by some of the world's largest banks, including Santander, BBVA, and J.P. Morgan. In fact, Ripple has already been used to improve the banking experiences of customers at some of the world's largest banks.

For example, Santander is using Ripple to improve its cross-border payments services. Ripple allows Santander to quickly and easily send money to Mexico and the Philippines. This helps reduce the time it takes to transfer money between these two countries, which is important because it can help businesses and people in these countries move money faster and more easily.

Similarly, BBVA is using Ripple to improve its cross-border payments services with Spain and Brazil. BBVA is able to reduce the time it takes to send money between these two countries by using Ripple's blockchain technology. This technology allows BBVA to quickly and easily verify the authenticity of the transactions that are being made.

J.P. Morgan is also using Ripple to improve its cross-border payments services. Ripple allows J.P. Morgan to quickly and easily send money to China and Japan. This helps reduce the time it takes to transfer money between these two countries, which is important because it can help businesses and people in these countries move money faster and more easily.

These are just a few examples of how Ripple can enhance the banking experiences of customers at Arab Bank Switzerland. Ripple is a technology that is being embraced by many of the world's largest banks, and this trend is only likely to continue. As a result, Ripple is likely to become an even more important part of the banking experience for customers at Arab Bank Switzerland in the future.

A Look at Why Arab Bank Switzerland Chose Ripple for Payments

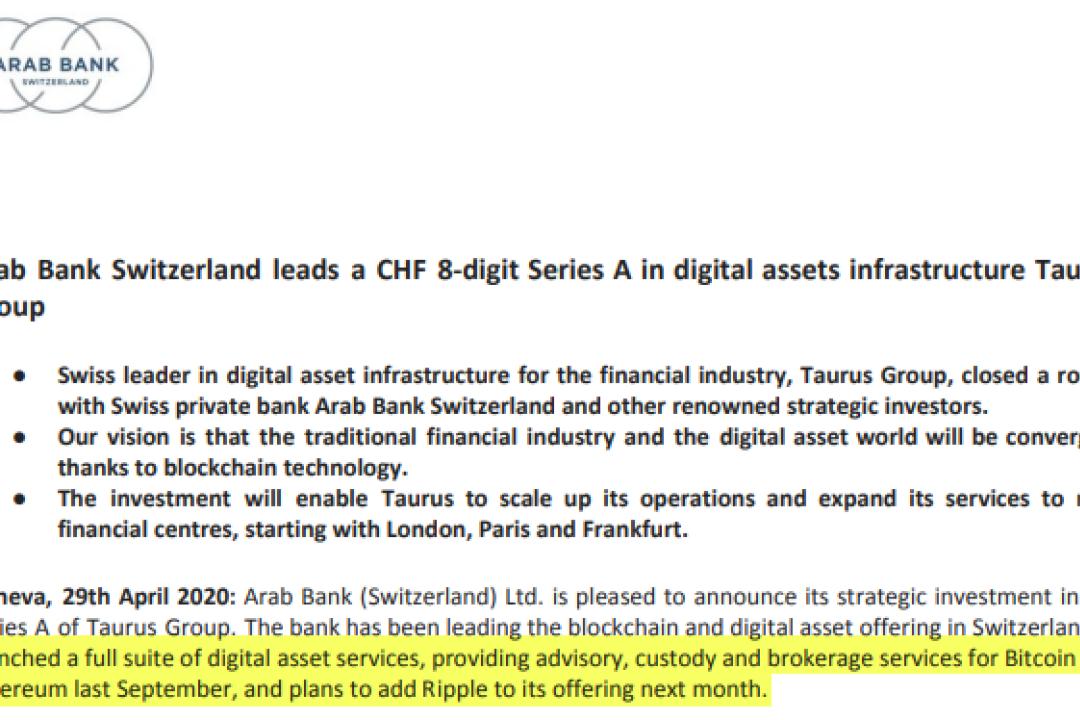

Arab Bank Switzerland is a global financial institution with over $160 billion in assets. It offers a wide range of services, including payments, securities trading, and wealth management.

In 2018, Arab Bank Switzerland began looking into how it could improve its payments infrastructure. It was interested in exploring new technologies that could help it speed up transactions, lower costs, and improve security.

One of the technologies that Arab Bank Switzerland considered was Ripple. Ripple is a global payment network that helps banks to quickly and easily send money to each other.

Ripple's technology is based on blockchain, a distributed ledger that allows for secure, transparent transactions. Ripple's platform is also highly efficient, meaning that it can process large numbers of transactions quickly.

Arab Bank Switzerland decided to use Ripple because of its ability to streamline payments and improve security. By using Ripple's platform, Arab Bank Switzerland can reduce the time it takes to process transactions and cut costs. Additionally, Ripple's platform is resistant to cyberattacks, making it an ideal option for financial institutions.

New Possibilities with Arab Bank Switzerland and Ripple Collaboration

Arab Bank Switzerland is looking to explore new opportunities with Ripple, according to a report from Arabian Business. The bank is reportedly in the process of setting up a pilot program with the Ripple network to improve its cross-border payments infrastructure.

This collaboration could potentially improve the speed and accuracy of transactions between Arab Bank Switzerland and its customers around the world. Additionally, it could help to reduce costs associated with sending payments across borders.

While this is just a pilot program at this point, there is potential for it to become a more widespread collaboration between Arab Bank Switzerland and Ripple. If this proves to be successful, it could be a major step forward in improving the speed, accuracy, and cost efficiency of cross-border payments.