What is Cryptocurrency Leverage Trading and the Risks Associated with it?

Understanding Cryptocurrency Leverage Trading and Its Risks

Cryptocurrency leverage trading is a strategy that involves purchasing a cryptocurrency with the hope of selling it at a higher price later. While it can be a profitable way to make money, there are also risks involved.

If the price of the cryptocurrency falls, the trader may lose money. If the price of the cryptocurrency rises too quickly, the trader could also lose money. Additionally, if the cryptocurrency market crashes, the trader could lose all of their money.

Cryptocurrency leverage trading is also risky because it is difficult to predict the future price of cryptocurrencies. If the trader loses money, they may not be able to recover it.

Exploring the Pros and Cons of Crypto Leverage Trading

There are many pros to leveraging crypto trading, but there are also some cons.

Some pros to leveraging crypto trading include the ability to increase your trading profits quickly, the potential for arbitrage opportunities, and the ability to take on larger positions without risking too much capital.

However, one potential downside to leveraging crypto trading is that you can also lose a lot of money very quickly if the market goes against you. Additionally, leveraged trading can also be risky and can lead to losses if you don't know what you're doing.

How to Utilize Crypto Leverage Trading Safely and Responsibly

Crypto leverage trading is a way to make profits by using borrowed funds to increase your investment. However, before you start leveraging your investment, it is important to understand the risks and how to use crypto leverage trading safely and responsibly.

1. Understand the Risks of Crypto Leverage Trading

When you are trading with crypto leverage, there are a number of risks that you need to be aware of.

The first risk is that you could lose all of your money if the price of the underlying asset (the cryptocurrency you are trading) goes down significantly. If the price of the underlying asset falls below the margin requirement you have set, then your broker will liquidate your position and you will lose all of your money.

Another risk is that you could lose all of your money if the price of the underlying asset goes up significantly. If the price of the underlying asset rises beyond the margin requirement you have set, then your broker will sell your position and you will lose all of your money.

2. Use Crypto Leverage Trading Safely and Responsibly

To minimize the risk of losing your money when you are trading with crypto leverage, it is important to follow a few simple rules:

Always set a margin requirement before you start trading. This will ensure that you do not lose any money if the price of the underlying asset falls below your margin requirement.

Only trade cryptocurrencies that you can afford to lose. Do not trade cryptocurrencies that you cannot afford to lose because this will increase the risk of losing your money.

Only use crypto leverage trading for short-term trades. Do not use crypto leverage trading for long-term trades because this will increase the risk of losing your money.

Always keep a close eye on the price of the underlying asset. If the price of the underlying asset falls below your margin requirement, then sell your position immediately. If the price of the underlying asset rises above your margin requirement, then buy your position immediately.

Do not invest more money than you are able to lose. If you are not comfortable with the risk of losing your money, then do not use crypto leverage trading.

Finally, be sure to read the terms and conditions of your brokerage account carefully before you start trading. Many brokerage accounts have limits on the amount of crypto leverage that you can use.

Risk Management Strategies for Crypto Leverage Trading

When trading cryptocurrencies, it is important to understand the risks involved. One of the most important risks is leverage.

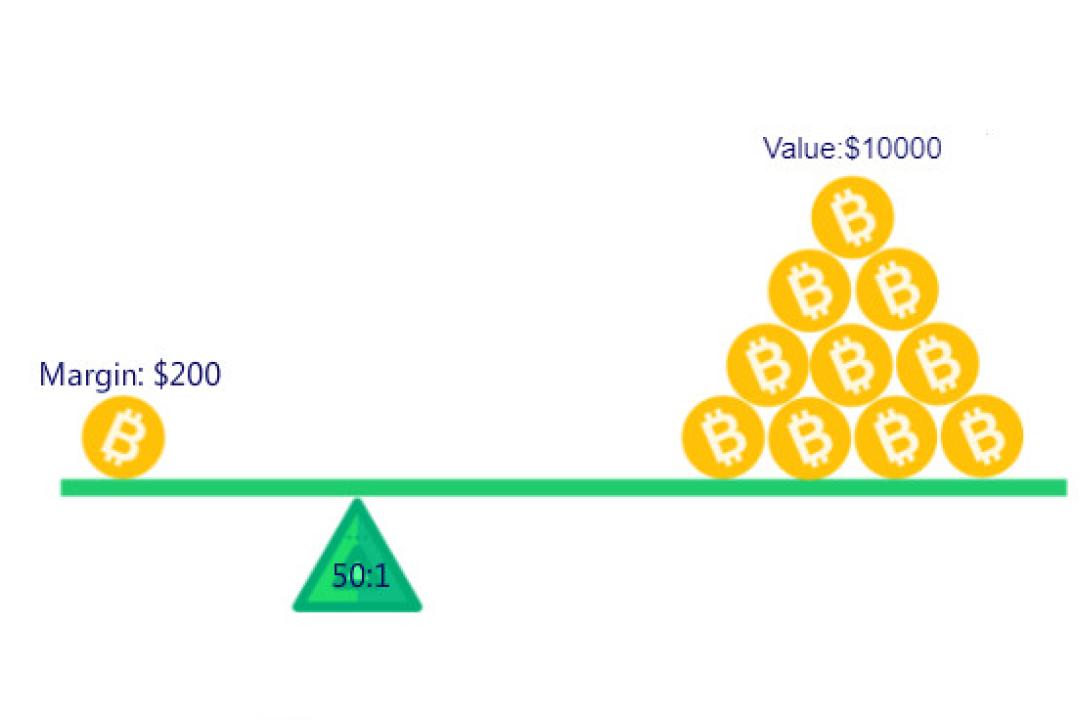

Leverage refers to the amount of money that one is borrowing to invest in a given asset. With cryptocurrency trading, leverage can be a big factor in your profits or losses.

When trading with leverage, it is important to understand the following:

How much leverage can I use?

How much money can I lose with leverage?

How do I protect my investment if something goes wrong?

How do I know when to stop using leverage?

There are a number of ways to use leverage when trading cryptocurrencies. The most common way is to use a margin account. This allows you to use up to 3x the amount of your account balance in leverage.

For example, if you have an account with $10,000 in total, you can use up to $30,000 in leverage (30x your account balance). If you use too much leverage, you could lose all of your money.

It is also important to understand how much money you can lose with leverage. The maximum amount you can lose with leverage is 100x your account balance. So, if you have an account with $10,000 in total, you can lose $100,000 with leverage (100x your account balance).

It is also important to understand how to protect your investment if something goes wrong. When using leverage, it is important to have a strategy for how to handle losses. Some common strategies include:

Closing your position quickly : If something goes wrong and you lose money with your position, it is important to close it out as quickly as possible. This will minimize the amount of damage that can be done.

: If something goes wrong and you lose money with your position, it is important to close it out as quickly as possible. This will minimize the amount of damage that can be done. Stopping trading: If you are losing money with your position, it is important to stop trading and adjust your strategy. This will help you avoid further losses.

If you are losing money with your position, it is important to stop trading and adjust your strategy. This will help you avoid further losses. Selling into weakness: If the market is going down, it is often best to sell your coins rather than hold on to them. This will help you avoid losses.

It is also important to know when to stop using leverage. If you are trading with a lot of leverage, it is important to have a strategy for when to stop using it. Some common strategies include:

Adjusting your position size: It is often best to adjust your position size if the market moves in your favor. This will help you maintain profitability while using leverage.

It is often best to adjust your position size if the market moves in your favor. This will help you maintain profitability while using leverage. Stopping trading: It is often best to stop trading if you are losing money with your position. This will help you avoid further losses.

It is often best to stop trading if you are losing money with your position. This will help you avoid further losses. Selling into weakness: If the market is going down, it is often best to sell your coins rather than hold on to them. This will help you avoid further losses.

What You Need to Know Before Trying Crypto Leverage Trading

Crypto leverage trading can be a very profitable investment opportunity, but it is also a high-risk activity. Before you start trading with crypto leverage, you should carefully consider the risks and rewards involved.

1. What Is Crypto Leverage Trading?

Crypto leverage trading is a strategy used to increase your profits by using borrowed funds to buy cryptocurrency assets. You borrow money from a margin broker or financial institution, and then use that money to buy more cryptocurrency assets.

2. What Are the Risks of Crypto Leverage Trading?

Crypto leverage trading is a high-risk activity. If the value of the cryptocurrency assets you are trading falls, you may lose all of your invested capital. Additionally, if the value of the cryptocurrency assets you are trading rises significantly, you may also lose all of your invested capital.

3. What Are the Rewards of Crypto Leverage Trading?

Crypto leverage trading can be a very profitable investment opportunity. If you are able to correctly predict the direction of the cryptocurrency market, you may be able to earn significant profits. However, you also risk losing all of your invested capital if the value of the cryptocurrency assets you are trading falls significantly.

Uncovering the Risks of Crypto Leverage Trading

Crypto leverage trading is a high-risk activity that can lead to loss of money if not done correctly.

1. You Could Lose Your Investment

The biggest risk with crypto leverage trading is that you could lose all of your investment. If you use too much leverage, you could lose all of your money if the market goes down.

2. You Could Lose Your Coins

Another risk with using crypto leverage is that you could lose your coins. If the market goes down and you have a large position in coins, you could lose a lot of money if the price drops.

3. You Could Lose Your Position

If you use too much crypto leverage, you could also lose your entire position. This can happen if the market goes down and you don’t have enough money to cover your losses.

4. You Could Lose Your Wallet

If you use crypto leverage and lose your wallet, you could lose all of your coins. This could happen if you forget your password or if someone steals your laptop with your crypto wallet on it.

5. You Could Lose Your Trading Money

Another risk with crypto leverage trading is that you could lose your trading money. This can happen if you lose money when the market goes down, and you don’t have enough money to buy back in.

6. You Could Lose Your Position in the Market

If you have a big position in the market, using too much crypto leverage could also lead to a loss of your position in the market. If the market goes down and you use too much leverage, you could lose all of your money.

The Benefits of Applying Leverage to Your Crypto Trades

One of the most important benefits of leveraging your crypto trades is that it allows you to increase your returns in a shorter period of time. When you trade with leverage, you are able to borrow money from a broker in order to increase your investment. This means that you can potentially make more money in a shorter amount of time, which can be helpful if you are looking to make quick profits.

Leverage also allows you to trade in a much larger amount of currency than you would be able to if you were not using leverage. For example, if you are trading with 1:1 leverage, you are able to trade 100x the amount of currency that you would be able to trade without leverage. This gives you a lot more flexibility when it comes to trading and can help you achieve greater returns.

Finally, using leverage can also help protect you from losses. If the value of your investment drops below the value of the loan that you have borrowed from your broker, your losses will be limited. This is because the amount of money that you have borrowed will be at least equal to the amount of money that you have lost. If the value of your investment drops significantly beyond the value of the loan, however, your losses can be much more significant.

Overall, leveraging your trades can be a powerful way to increase your returns and protect yourself from potential losses.

Mitigating Potential Losses With Crypto Leverage Trading

Crypto Leverage Trading is a trading strategy that uses borrowed money to amplify profits and reduce losses. The strategy is used to trade cryptocurrencies with high risk and high potential returns.

Crypto Leverage Trading is a high-risk, high-return trading strategy that involves borrowing money to amplify profits and reduce losses. The strategy is used to trade cryptocurrencies with high risk and high potential returns.

When you use Crypto Leverage Trading, you are essentially borrowing money from a broker or lender to increase your trading exposure. You then use this extra money to buy more cryptocurrencies, which increases the potential for profits. However, this also increases the risk of losing all your money.

Crypto Leverage Trading is a high-risk, high-return trading strategy that involves borrowing money to amplify profits and reduce losses. The strategy is used to trade cryptocurrencies with high risk and high potential returns.

When you use Crypto Leverage Trading, you are essentially borrowing money from a broker or lender to increase your trading exposure. You then use this extra money to buy more cryptocurrencies, which increases the potential for profits. However, this also increases the risk of losing all your money.

Crypto Leverage Trading is a high-risk, high-return trading strategy that involves borrowing money to amplify profits and reduce losses. The strategy is used to trade cryptocurrencies with high risk and high potential returns.

When you use Crypto Leverage Trading, you are essentially borrowing money from a broker or lender to increase your trading exposure. You then use this extra money to buy more cryptocurrencies, which increases the potential for profits. However, this also increases the risk of losing all your money.

Deciphering the Dangers of Crypto Leverage Trading

Crypto leverage trading is a risky investment strategy that can lead to losses. When you use crypto leverage, you are borrowing money from a brokerage account to increase your position size. This increases your risk exposure and the potential for losses.

If the price of a cryptocurrency falls, your position will lose value. If the price of a cryptocurrency rises, your position will gain value. If the cryptocurrency price falls significantly, your position may become worth nothing.

If the price of a cryptocurrency rises significantly, your position may become worth more than the amount you originally borrowed. If the price of a cryptocurrency falls significantly, your position may become worth less than the amount you originally borrowed.

Crypto leverage trading is also risky because it can increase your exposure to market volatility. Cryptocurrencies are highly volatile, and the prices of cryptocurrencies can change rapidly. This can lead to sudden losses in your investment if the market volatility increases.

If you are using crypto leverage trading, be sure to do your research and understand the risks involved. Only invest what you are willing to lose.

Harnessing the Power of Crypto Leverage Trading

Crypto Leverage Trading is a revolutionary new way to trade cryptocurrencies that allows you to increase your profits by using borrowed funds to buy higher-priced cryptocurrencies.

Leveraged trading is a popular trading strategy that allows you to increase your profits by using borrowed funds to buy higher-priced cryptocurrencies. With Crypto Leverage Trading, you can use a small amount of capital to buy a larger amount of a cryptocurrency, which allows you to increase your return on investment.

How Crypto Leverage Trading Works

When you use Crypto Leverage Trading, you borrow money from a financial institution or another individual to purchase a higher-priced cryptocurrency. The money you borrow is then used to buy the cryptocurrency, and the difference between the price at which you purchased the cryptocurrency and the price at which you sold it is your profit.

The key to Crypto Leverage Trading is to purchase a cryptocurrency at a low price and then sell it at a higher price. By doing this, you can increase your return on investment while minimizing your risk.

Crypto Leverage Trading Benefits

Crypto Leverage Trading is a powerful tool that can help you increase your profits by using borrowed funds to purchase higher-priced cryptocurrencies.

Crypto Leverage Trading is an easy way to increase your return on investment.

Crypto Leverage Trading is safe and secure.

Crypto Leverage Trading can be used with any cryptocurrency.

Evaluating the Risks of Investing in Crypto Leverage Trading

Crypto leverage trading can be a very risky investment, as it increases the potential for loss. For example, if you invest in a cryptocurrency that falls in value, your losses could be amplified if you use leverage to trade that cryptocurrency.

Leverage also amplifies the effects of market volatility. If the value of a cryptocurrency falls sharply, using leverage can cause your losses to be even greater. In extreme cases, leverage can also lead to financial ruin.

If you are considering investing in crypto leverage trading, it is important to carefully consider the risks involved. Before making any decisions, it is important to consult with a financial advisor to ensure that you are fully aware of the risks involved.